Credit: USA Today

Many years ago, I worked in a bank. We served mostly low-income customers, and February, as always, was Tax Refund Time.

And people who I knew to be cash-poor would come in with $7,000 tax refund checks. At the time, I was ignorant. I just thought they were “lucky.”

For years, without kids and my husband and I having a dual income, we would get no refund – nor would we owe tax back. For us, April 15 loomed like a dark day of reckoning.

At that time, it was easy to see those thousand-dollar returns and think, “Well, this just isn’t fair.”

This year, however, my family is the one that will be getting a large refund. And it has really put some things into perspective.

And I’m a little ashamed at the privileged judging I did in previous tax years. We shouldn’t have to literally live the other side to have compassion and understanding for the circumstances of others.

So here’s what I wish I’d known before so that I would understand why some people get so much and others get so little with their tax refunds.

Myth #1: The Poor Pay No Tax

Truth: Only 17% of all taxpayers had zero income and payroll tax liability

This is a huge myth in our country, especially after the “47%” comments made by Mitt Romney during the 2012 election. Is there really this huge amount of people who are paying no taxes?

In reality, the 47% number refers only to income tax. So, for example, this year, I have no tax liability due to my income, credits, exemption, and so on. My tax liability is zero.

However, since my household has an earned income, we still pay payroll taxes, as well as state and local taxes. The Tax Policy Center found that only 17% of all taxpayers had zero income and payroll tax liability (and note that 60% of those, or 10.3% of total taxpayers, were elderly).

Additionally the poor are disproportionately hit by state and local taxes. On average, across all fifty states, the poorest 20% pay 11.1% of their income in state and local tax.

Even worse, in states with so-called regressive tax laws, the rate is as high as 16% of their income; meanwhile, the richest are paying only 2.8%.

Myth #2: Tax Programs That Assist The Poor Discourage Work

Truth: Tax programs actually increase workforce participation.

Often, conversations regarding the poor and tax refunds comes around to something to the effect of: “Well, I’ll just quit my job and work at Wal-Mart. Then I’ll get a big refund.” This line of thinking implies that the poor are being rewarded for working less.

In actuality, the Earned Income Tax Credit (EITC), one of the largest tax programs for the poor, increases as your income increases. It therefore incentivizes working more, not less.

This graph, from the Center on Budget Policy and Priorities, shows the distribution of EITC benefits.

You can see here that the amount of EITC a family receives rises steadily as they generate more income. It then plateaus for low-income earners and gradually decreases in the upper income ranges. It is clear from the chart that a statement like Wisconsin State Senator Glenn Grothman’s – “If you have a child, you’d be better off making $16,000 than $36,000” – simply isn’t true.

It is set up this way so that there isn’t really an income at which working less next year is a viable option. Rather, estimates say that EITC caused an increase in the workforce of 500,000 people.

Myth #3: The Tax Programs Encourage Women To Be Baby Mills

Truth: The cost of raising a child far outweighs the tax deductions a child receives.

In 1976, when Ronald Reagan was running for the presidential nomination, he often brought home his point about welfare abuse by referring to “a woman in Chicago.” “She has eighty names, thirty addresses, twelve social security cards,” he hyperbolically explained. “She’s got Medicaid, getting food stamps, and she is collecting welfare under each of her names. Her tax-free cash income alone is over $150,000.”

She was dubbed The Welfare Queen by the media. The problem? She doesn’t exist – and she never did. (1).

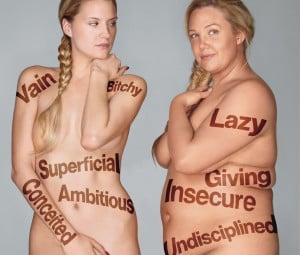

The myth of the welfare queen has perpetuated for so long because it fits in nicely with many of people’s preconceived notions about poor people — not to mention the myth’s inherent racism.

This misconception that there are people living fat off of welfare and birthing more children to collect money has been soundly debunked by research.

And actually, as far as taxes go, the provisions are limited in such a way that being a baby mill isn’t lucrative.

The EITC only increases for children up to three. The final category, “three or more,” makes it so if you have four or fifteen kids, you still receive the “three or more” rate.

The other big tax credit for families is the Child Tax Credit (CTC). This is a set amount per child under seventeen, and it can be partially tax-negative (in other words: unrefundable). Here is a chart from the Tax Policy Center:

Once again, the amount of the CTC rises steeply with increased income in the lower income bracket. It plateaus and then tapers — this time, after $110,000 for a married couple filing jointly. The purple bars indicate what percentage of “eligible children” are actually getting the CTC benefit. It is near to 100% for the second quartile of earners.

The refundability of the CTC is currently capped at $3,000 regardless of how many children a family has. Therefore, it is a false — and classist — belief that having babies is incentivized by the government. (Although this writer feels that the poor, “horny, short-term focused person [will] likely at least consider having several kids” as a result of the CTC. Eye roll.)

Assumptions about the intelligence of the poor aside, anyone with children knows that $1000 per child (which equals out to $83 per month) while nice, does not offset the actual cost of raising a child.

The fact is: raising kids is expensive, and parents work hard to provide financially, as well as emotionally, for their children. This is something that we all benefit from, and it is in our best interest as a nation to supplement the lowest income families in doing so.

Myth #4: The Tax Programs Are Anti-Woman

Truth: Tax programs are one of the main things responsible for decreasing the number of women on welfare and getting more women in the workforce.

There are tax laws that disadvantage women. For example, the lower income in a family (often the woman’s) is taxed at her spouse’s higher level, deincentivizing a wife working outside the home (which, actually, was its intent).

As far as tax credits go, though, there are two specifically pro-woman incentives. One is that EITC helps working women by having a particularly significant effect on female-headed households (IRSese for single moms) by both raising the number of women in the workforce and decreasing the number of women and children on welfare.

Secondly, for women who choose to be primary caregivers for their children, the EITC is available based on family income. This is unlike some credits, like the Child and Dependent Care Tax Credit, which are only available to families with two earned incomes.

(Note: I’m not advocating either working or stay-at-home mothering but pointing out that tax codes that penalize or incentivize one or the other isn’t very pro-woman.)

Myth #5: They Just Spend It On Frivolous Stuff

Truth: Over 80% of tax refund are spent to pay down debt or put into savings.

I am going to save you from having to read some of the hateful vitriol I’ve found on this topic. Do yourself a favor and don’t Google “poor people waste tax return.” I’ve done it for you. Just as a representative sample:

“The Earned Income [Tax] Credit lets deadbeats work about two months and they get six or seven thousand dollars when they didn’t even make that much money the whole year in wages. The money goes to a new flat screen tv, a piece of shit car that will run for three months, booze, dope, and other stupid items. This is another huge waste of taxpayers money.”

I’ve read pages of this stuff. But lest you think it is just Internet trolls, the same concept, wrapped in glittery political terms, is showcased in Paul Ryan’s Roadmap Plan under the phrase “erosion of American character.”

The bottom line? This really isn’t any of your business. Being poor does not give you free reign to police someone else’s choices or lifestyle.

However, it is also false. For all taxpayers, 41.7% of tax refunds are spent on paying down debt, while 42.9% go to savings. Sadly, another 29% are used for basic living expenses.

And this detailed study shows that for those receiving EITC, up to 65% spend their refund to pay bills or pay down debt. An additional 29% spent the money on repairs, like on their cars, for example.

So What Is The Truth?

EITC alone is responsible for raising 8.9 million people (including 4.7 million children) out of poverty every year.

As President Clinton said when expanding the program in 1998, EITC is “not about more governmental or social workers, or more services. It’s about more groceries and a car, more school clothes for the kids, and more encouragement and hope to keep doing the right thing.”

So, really, there is no need to be jealous of a $6,000 tax return.

Be proud. That tax return is our society lifting people out of poverty, giving them the means to work to better themselves and the lives of their children — our future.

(1) Reagan appears to have taken three different cases of extreme fraud and rolled them into one person and then adding more exaggeration while also implying that this problem was rampant.

Want to discuss this further? Login to our online forum and start a post! If you’re not already registered as a forum user, please register first here.

Paige Stannard is a Staff Writer for Everyday Feminism. She’s a former NASA research librarian happy to be home raising her 3 IVF babies after nearly a decade of infertility. She blogs about infertility, parenting, and women’s issues at Baby Dust Diaries as well as being the founder of the gentle discipline site ParentingGently.com and co-founder of the breastfeeding rights site NursingFreedom.org. She likes to cook and sew and has, in general, become her mother. Happily. Book her for speaking engagements and follow her on Twitter @babydust.

Search our 3000+ articles!

Read our articles about:

Our online racial justice training

Used by hundreds of universities, non-profits, and businesses.

Click to learn more